Every publicly traded company risks becoming the target of so-called "activist investors". Are the Autodesk activist investors blood-sucking shareholder leeches or corporate rapists?

At PW we have no patience for opportunistic capitalist pirates. They are one of the viruses spawned by modern capitalism. Running under the cover of the positive banner "activists", you know, people who try to do good things in the world, these uber-rich capitalist pirates roam the business world looking for companies where they can leverage their wealth, or in this case as hedge funds, the wealth of others, in order to drive a company to short-term share gains, sell out, walk away, and leave a financial carcass behind.

Yeah, we love these guys.

Autodesk is under attack. The company just allocated a board seat to Eminence Capital and Sachem Head Capital. These are not companies who understand technology, and they certainly do not understand the demands of running an engineering and multimedia software company which can only thrive on innovation, quality and delighted customers. Autodesk is a serious technology business on which manufacturing and entertainment giants depend. It's not the Men's Wearhouse which was driven into the ground because some of these same "activist" investors fired the company CEO and founder, George Zimmer, and then spectacularly proved that they did not understand the company's retail business.

Will these hedge funds rain down their Men's Wearhouse incompetence on Autodesk?

Scott Fergeson, head of Sachem Head Capital, has been given a seat on the Autodesk board of directors - on the compensation and human resources committee. Influence over management's money and employee layoffs - who could ask for better leverage over the future direction of a company?

A standstill agreement has been announced. It will expire September 30th which is a shorter than normal time-frame if you can call raping a company normal. The effects have already been felt by Autodesk employees with a layoff of 10% of the company's human capital. Officially, Autodesk denied any relationship between the layoffs and the hedge fund investors, but the timing indicates otherwise. Look for more short-term, financially targeted business decisions before this fall, ... and perhaps a flood of them after October 1st.

The timing is not an accident. Autodesk is in the middle of a multi-year process to transition from a sales model on which it and every other software company in the 1980s was founded, perpetual licensing. Autodesk is moving to a modern licensing model, cloud subscription services. The effect of this transition is to suppress revenues during the transition period with long-term gains thereafter. Adobe made this transition and proved that a company can increase revenue under the new model.

What to look for

These corporate leeches have a hammer and every problem is a nail. Look for more volatile stock swings at Autodesk this year. The leeches leverage that to further increase their positions. Keep an open eye for various short-term cost savings even before the end of the corporate cease-fire. Will there be more layoffs this summer? Likely. Will the company tighten its belt on marketing and sales? Probably. What about reductions in basic R&D? If not now, then after the cease-fire. If the hedge funds increase their stakes during the year, look for life to change at Autodesk on October 1st.

And look for machinations from these corporate leeches to drive a merger or buy-out. It is a favorite technique to churn the stock price, increase their positions in the price-valleys, and convince some gullible suitor of the hidden value in their "gem". In reality, the corporate raiders just turn the company into a turd and then polish it for their corporate match-making.

Look for pressure on top management. This is their leverage. As with The Men's Wearhouse, they fired the founder and CEO and then ruined his company. Of course the goal is not to fail spectacularly, but to drive up the company valuation in the short term, take in their haul, and walk away. Whatever is left behind can live or die. Eminence Capital walked away from Keurig Green Mountain with a cool $429 million profit.

Who will win?

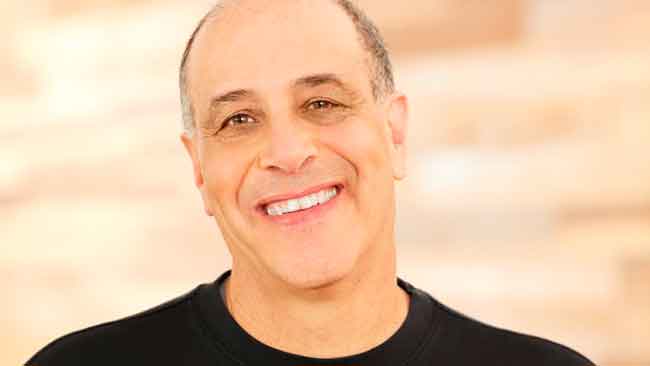

The good news for Autodesk fans is that CEO Carl Bass is extraordinarily intelligent, capable, and visionary. As are many members of the Autodesk management team. Carl joined the company in the early 90s when his own technology company, Ithaca Software (the creators of HOOPS), was acquired by Autodesk. Carl Bass eventually passed through the office of CTO before taking the helm of the company. He could be the most capable CEO in the company's three and a half decade history. These technology illiterate hedge fund managers have picked a tough fight.

Carl Bass did not mince words when Sachem Head Capital revealed its 5.7% stake.

“I don’t think these guys care one bit about return on investment. I think active investors, as the name suggests of their behavior, they are here for a short hit,” Bass said at a Tokyo press event. “You could cut every expense in almost every technology company and get better returns for the short term, and I would almost guarantee you would have no long-term future.”

All of us from the industry know that Carl Bass is right.

The PW perspective

At PW we are being purposefully derogatory regarding these capitalist pirates, share-holder leeches, corporate rapists. They pretend to present themselves as a natural check and balance on company management.

They are nothing of the sort. They are abusers of what corporate law permits raping and pillaging for their own profit. They add nothing to the real value of a company which can never be measured solely through a stock price.

At PW we believe in innovation. We believe in the development of new tools and technologies which help companies product more efficient, transformative and creative products and services. We understand that in order to achieve these objectives that investments need to be made which may or may not pay off years down the road.

We know that companies need to invest in people because people create and innovate. People who do not live under the threat of imminent unemployment are more productive and more empowered.

And at PW we understand that these so-called "activist" investors don't give a rip about any of these things.